Top 12 Open Source Code Security Tools

Open source software is everywhere. From your server to your fitness band. And it’s only becoming more common as over 90% of developers acknowledge using open

It’s natural to want to believe that every new account creation or online purchase signals the legitimate growth of your business. But the alarming rise in financial and data losses attributed to fraud, suggests a different reality. There are thousands of bad actors actively looking to nickel and dime businesses and consumers.

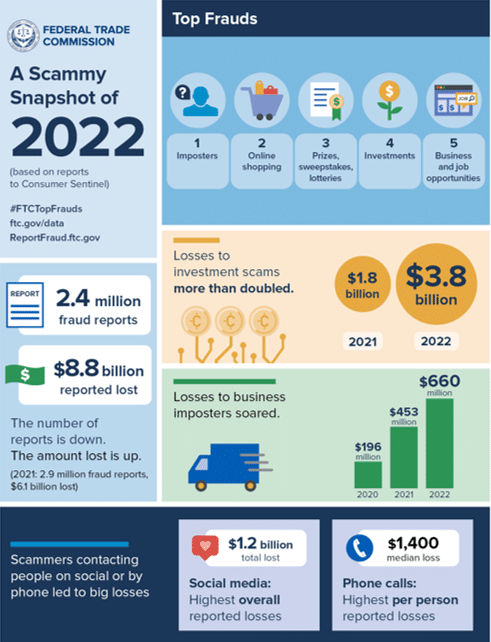

In 2022, a staggering 2.4 million fraud reports flooded the Consumer Sentinel Record. This underscores the urgent call for businesses to fortify their defenses with cutting-edge fraud detection solutions, ensuring their assets and reputations remain uncompromised.

Dive into the importance of fraud detection for your business, the key considerations when exploring your options, and discover the top 10 solutions projected to lead the way in 2024.

Fraud is costly for all involved parties. According to the FTC, consumers lost a record $8.8 billion to fraud in 2022. For businesses, a single large-scale fraud attack can cost in excess of $50 million between financial losses, reputation damage, and regulatory fines.

Fraud has existed as long as financial systems have existed, but today’s fraudsters are employing increasingly sophisticated techniques around the loopholes and blindspots in digital systems. In response, businesses are clamoring to stay one step ahead.

Modern fraud detection tools implement AI, machine learning, and other advanced technologies. Advanced algorithms trained on massive volumes of financial transactions and consumer behaviors can identify activities that are potentially fraudulent – blocking the transaction and locking the account or referring it to human investigators for further review.

In an era where cyber threats loom large, how do you choose the best fraud detection solution from the sea of available options? Start by considering these general yet critical factors before moving on to more specific features that your business is seeking:

MEMCYCO specializes in detecting and preventing brand impersonation, commonly known as “brandjacking.” It offers real-time monitoring against fake websites, alerts users when they access cloned or spoofed versions of your site, and displays a forge-proof authenticity watermark to assure visitors of the site’s genuineness.

Digital businesses at risk of brandjacking

$750 per year based on 5,000 monthly visits. Up to $20,000 per year based on 200,000 monthly visits.

“We are very satisfied with MEMCYCO and recommend it fully. It has finally provided us with a solution to plug a big gap in our cyber security needs.”

Fortiro provides specialized tools for automating financial document reviews, instantly verifying income documents, and conducting real-time fraud checks. This not only minimizes fraud losses but also reduces the verification process from hours or days to just 30 seconds, eliminating the costs associated with manual reviews.

Lending platforms, banks, and financial institutions.

Pricing is based on features and number of documents. Contact Fortiro for pricing.

“Forter reduces the overhead required to maintain traditional rules based fraud platforms and manual human review. As a consumer, it is a relief to know that services like Forter exist to protect us from fraudulent activity on our accounts.”

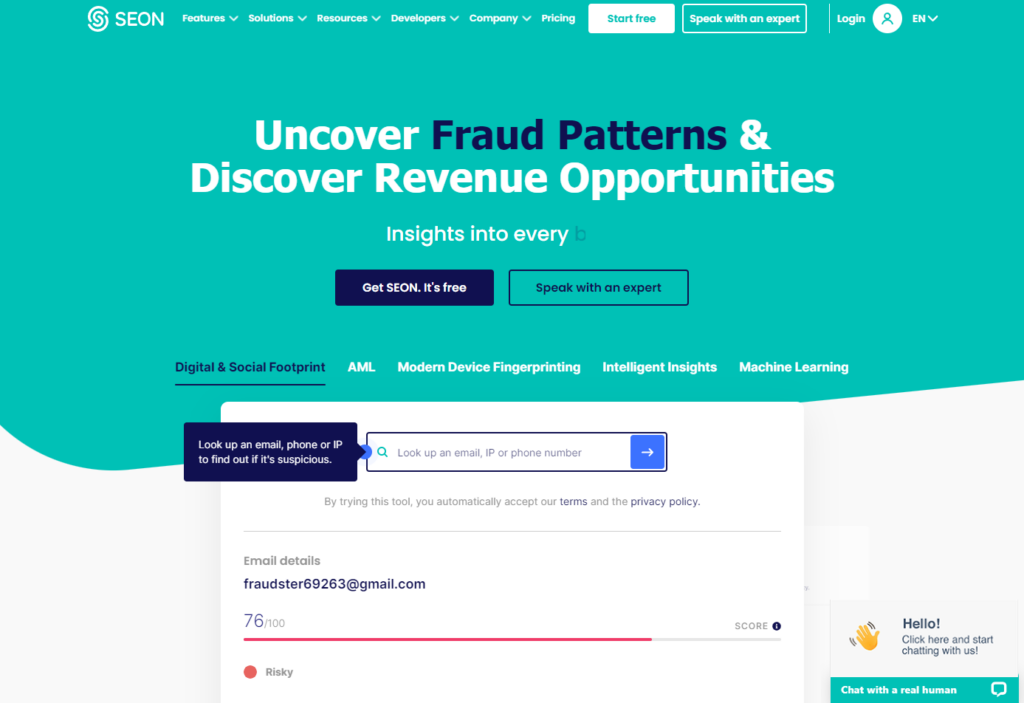

3. SEON

Full-suite fraud detection solution that assists with account takeover, chargeback fraud, checkout fraud, payment fraud, transaction monitoring, and AML checks.

Small to medium-sized businesses.

Freemium pricing structure starts at $0, while the Starter plan is $599 per month.

“SEON. Fraud Fighters has proven to be an invaluable tool in mitigating risk for our business. Its ability to rapidly identify and prevent fraudulent transactions has greatly increased our operational efficiency, while its API integration feature allows for seamless data exchange with our existing systems.”

Sift offers payment protection, account defense, content integrity that prevents suspicious posts that erode consumer trust, and dispute management to protect against chargebacks.

Online marketplaces, retail, fintech, digital goods & services, and more.

“The upside of using Sift is that it automates most of the fraud operations processes on our end. It makes things easier in terms of implementing risk controls, queues, and workflows.”

ArkOwl provides a comprehensive email verification tool that aggregates real-time data from various sources, including social media, webmail providers, and domain databases. It supports API and batch queries for bulk email checks, highlights crucial email validation details, and has expanded its services to include real-time phone number verification.

Financial institutions, e-commerce stores, subscription services, and more.

Contact for pricing. Get started with a Free Trial.

“False positives and false negatives come from information that is out-of-date….ArkOwl depends on real-time data from many live sources as well as drawing from its own database. This results with information being always up-to-date in the moment of the query made on the ArkOwl service.”

Riskified helps businesses fight chargebacks and resolve disputes, block fake accounts, prevent account takeovers, block resellers from hoarding, monitor refunds, and comply with regulations.

E-commerce platforms and digital goods providers.

Contact Riskified for pricing.

“I have worked in the E-commerce Fraud industry for the last 9 years, working with different fraud solutions. I can 100 % say that Riskified is the best one so far. The accuracy of the decisions is impeccable, the dashboards and the tool are very user-friendly.”

Prove’s PRO Model of Identity Verification, uses verifiable possession, reputation, and ownership factors for the user’s provided phone number to ensure that consumers are who they say they are.

Small to mid-market businesses. Mobile platforms, online services, healthcare, and more.

“Prove PRO model represents the best technology in the marketplace that can stop fraud. The concept of using phone-centric identity verification is extremely effective in fighting fraud.”

Kount offers a comprehensive suite of solutions for e-commerce, including real-time identity verification, new account fraud prevention, and account takeover protection. They provide payment-related services like fraud detection, chargeback management, and authorization optimization, coupled with compliance tools such as global watchlist searches, regulatory reporting, and customer due diligence.

E-commerce businesses and payment platforms.

“We use Kount in multiple ways to defend our checkout process from fraud. It provides a defense from volume attacks and provides scoring of our transactions so that we can automatically reject, review, or accept them.”

Signifyd supports merchants with chargeback protection and recovery, guaranteed fraud protection, return abuse prevention, and account protection. For payment providers, Signifyd offers a payment optimization platform.

E-commerce platforms, digital marketplaces, and payment providers.

“So far, after tracking thousands of orders, it has scored 100% of catching fraudulent orders. That is why we signed up for their service in the first place, so we are pleased with its accuracy.”

TruValidate™ combines robust data to verify consumer identities with device proofing and IP intelligence, assess risks through advanced device intelligence, and uncovers hidden fraud patterns.

Financial institutions, online services, insurance, healthcare, and more.

Contract TransUnion for pricing.

“The ability to share information amongst various representatives of the fraud-prevention community is quite vital in order to identify any emerging trends of new fraud cases across the insurance/finance industry.”

It’s important to understand that malicious actors are unlikely to stop at committing fraud. Given the opportunity, they will escalate their tactics, launching sophisticated cyberattacks and orchestrating data breaches. The interconnected nature of networks and digital systems means that a weakness in one area can potentially open doors to multiple threats.

If you’re looking to prevent malicious activities on the backend, SpectralOps can help. SpectralOps monitors your entire cloud network and seamlessly integrates with your existing CI/CD pipeline to look for vulnerabilities that start in your codebase. Get started with SpectralOps today!

Open source software is everywhere. From your server to your fitness band. And it’s only becoming more common as over 90% of developers acknowledge using open

It’s easy to think that our code is secure. Vulnerabilities or potential exploits are often the things we think about last. Most of the time, our

Experiencing a data breach is never pleasant. Just ask any of the hundreds of businesses that suffered a data breach in the past year, exposing billions